TPW Advisory July Monthly: Stuck in Reverse

Here is the full Monty my fellow TPW citizens - all 7000 words & 37 charts it!

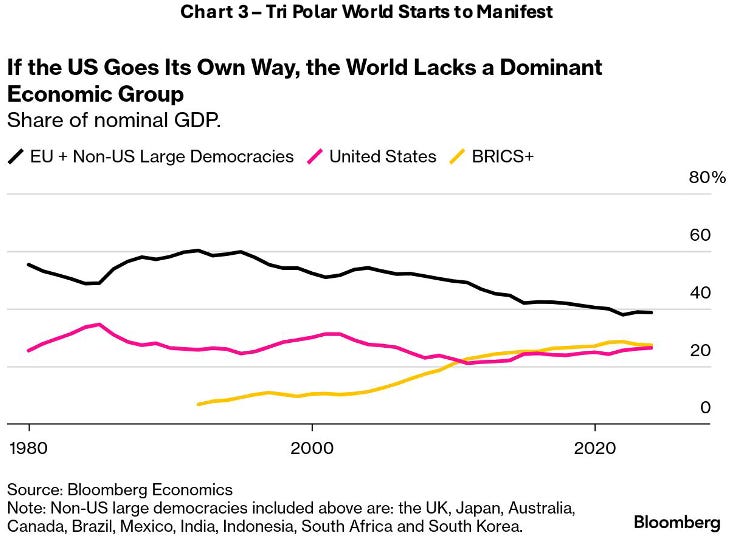

As we enter the 2H of 2025 with an eye on the 2026 horizon and beyond there is no shortage of issues large and small for one to focus on. This is a constant in global macro land but today’s environment of tectonic plates shifting across the Tri Polar World’s (TPW) three main regions of Europe, Asia & the Americas makes it a critical time to be able to separate signal from noise. This ability is always important but at times of big change or “Giant Steps” as we wrote recently – its mission critical.

At TPW Advisory, we remain focused on our Stoic Investment Strategy for the Age of Trump with its three key principles: first, ignore whatever Trump or his Admin says; second, focus on what he does & third, pay attention not to the news but to the asset price reaction to the news.

We termed the ability to ignore Trump’s verbiage an investing superpower when we wrote Stoic Strategy because it allows one to focus on other, much more important things, like the deeper integration taking place in Europe and Asia, as Trumpian policies take the US backwards while accelerating positive policy shifts in Asia and Europe.

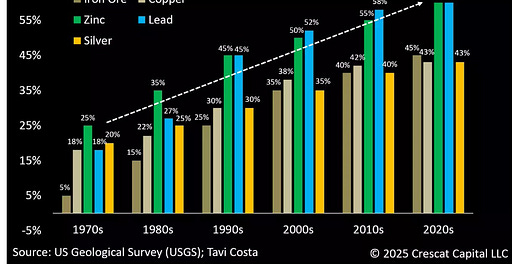

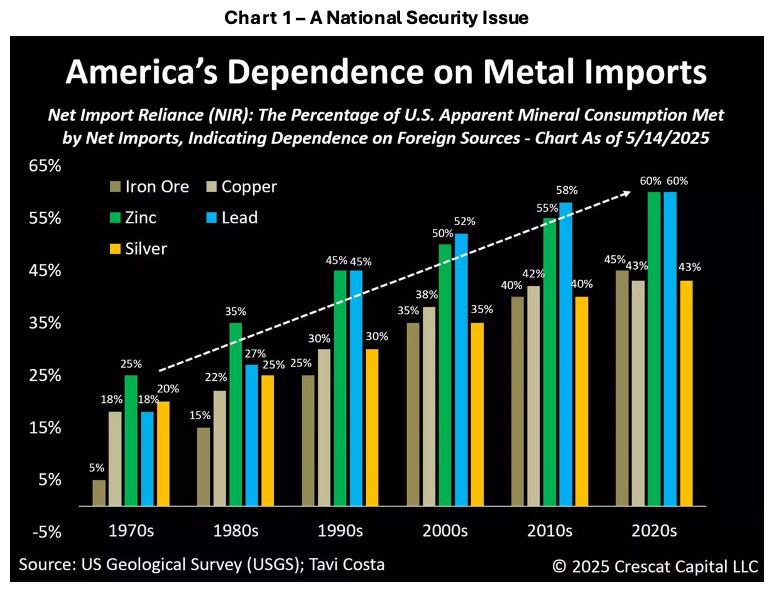

We believe the world is reshaping right in front of our eyes as the TPW manifests in real time. There are three main drivers to this reshaping with an AI sovereignty thesis overlaid on top. First, is the growing desire across Europe, Aisa and the Americas for production to be regionalized – a process jumpstarted by the Covid era reshoring, nearshoring and friendshoring thrust. Second, is the sanctions driven, national security based desire for domestic access to critical raw materials first weaponized by the Chinese via its rare earths dominance as a reply to Trump’s tech sanctions. China’s rare earths ban swiftly brought the US back to the negotiating table and represented the first salvo of this new front.

Trump has now upped the stakes with his threat to place 50% tariffs on US copper imports, arguing that the US needs to have domestic copper mining & smelting capacity even though Chile, Canada and Peru, the three main copper exporters to the US, are themselves part of the Americas pole.

Third & perhaps most interesting is the growing discussion around regional FX blocs as Europe & China seek to leverage the US pullback from the global stage. The dollar’s YTD decline has opened many minds to the upside of a “global Euro” to use ECB Chair Lagarde’s phrase. Chinese policy makers have been quick to follow, noting their desire to have the Chinese Yuan play a more central role in what China terms a multi polar currency world.

A Tri Polar World monetary system consisting of the Euro for Europe, the Chinese Yuan for Asia and the USD for the Americas will bring our TPW thesis full circle. The development of all three phases of this process (the regionalization of raw material capacity, manufacturing production and capital) will cement a new TPW operating system.

Keep reading with a 7-day free trial

Subscribe to The Tri Polar World to keep reading this post and get 7 days of free access to the full post archives.